Find Reliable Ohio Vehicle Insurance in Minutes

- Trent Oyer, CIC

- Jul 14, 2025

- 4 min read

Updated: Jul 24, 2025

When it comes to protecting your vehicle, finding reliable Ohio vehicle insurance can sometimes feel overwhelming. Trust me, I’ve been there—trying to sift through countless policies, rates, and fine print only to feel more confused than ever. That’s why I want to share how you can secure dependable vehicle insurance in Ohio quickly and confidently, without all the stress.

Why Reliable Vehicle Insurance Matters

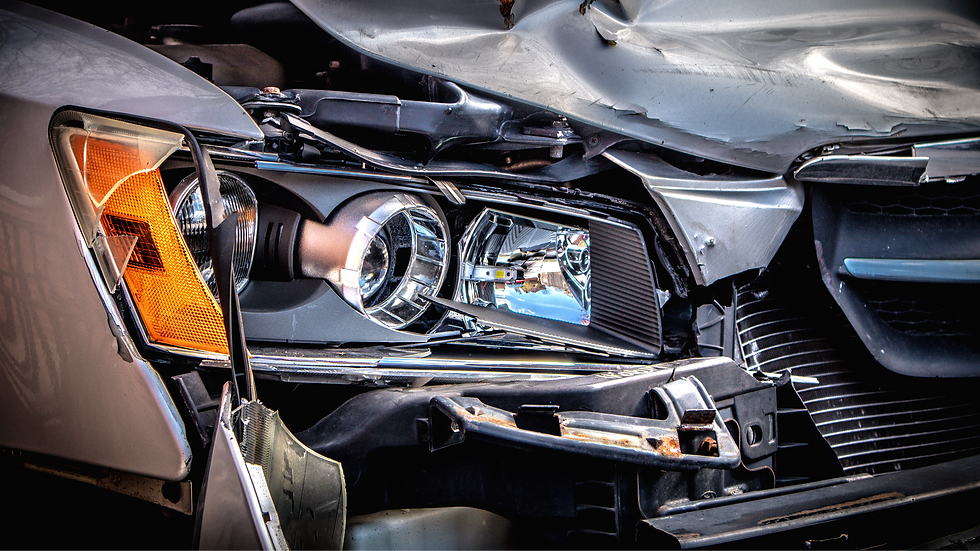

First off, vehicle insurance isn’t just a legal requirement in Ohio; it’s your financial safety net on the road. Accidents happen, no matter how careful you are, and having the right insurance coverage can save you from hefty out-of-pocket costs, protect your assets, and give you peace of mind.

But “reliable” means more than just meeting Ohio’s minimum insurance standards. It means coverage that fits your unique needs, offers excellent customer service, and provides fair claims handling. Finding that perfect balance might sound tricky, but it’s absolutely doable—and I’ll explain how.

Step 1: Know What You Need

Before jumping into quotes, it helps to know what types of coverage you should consider. Ohio requires liability insurance of $25,000 per person, $50,000 per accident, and $25,000 property damage which covers damage or injuries you cause to others in an accident. Once those limits are met the insurance company stops paying and you start. Many are unable to pay beyond that and the court can garnish wages or require assets are sold to repay what you are financially responsible for. More liability is highly recommended as well as these additional coverages:

Collision Coverage: Pays for repairs to your vehicle after an accident.

Comprehensive Coverage: Protects against theft, vandalism, or natural disasters.

Uninsured/Underinsured Motorist Coverage: Guards you if the other driver lacks sufficient insurance.

Medical Payments Coverage: Helps with medical bills for you and passengers.

Gap Insurance: Covers the difference between what your vehicle is worth at the time of loss and your loan amount

Rental Car: If you have a comprehensive or collision claim this will provide you a rental car until your vehicle is repaired or totaled out. It typically has a dollar per day limit and maximum time limit.

Understanding your driving habits, vehicle value, and budget helps you select the right coverage. Reliable insurance isn’t a one-size-fits-all, so getting clear on your needs upfront makes the next steps faster and easier.

Step 2: Use Trusted Resources to Compare Quotes

The key to finding reliable Ohio vehicle insurance in minutes is using a trusted agency or comparison tool. I recommend working with a local, experienced agency like Oyer Insurance Agency. They specialize in Ohio insurance and understand the nuances of state requirements and local driving risks.

When you contact an agency, you can get personalized quotes quickly. They’ll ask you relevant questions—such as your driving history, vehicle details, and coverage preferences—and then provide competitive options tailored to you. This personal touch beats generic online quote forms because it ensures accuracy and relevancy.

If you prefer to start online, many websites allow you to enter your information once and receive quotes from multiple insurers instantly. Just be sure to use reputable sites and verify the quotes with an agent to avoid surprises later.

Step 3: Evaluate Coverage, Not Just Price

It’s tempting to pick the cheapest insurance quote, but reliable insurance is about value, not just cost. When comparing options, look closely at:

Coverage limits: Are they sufficient for your needs and budget?

Deductibles: How much will you pay out-of-pocket in a claim? Does my lienholder require specific minimum deductibles?

Policy exclusions: What’s not covered? Does my policy cover permissive use and what coverages would apply?

Insurance company fees: Do you typically pay late? How much is that fee?

Required documentation: Some companies will require more information to be verified after the policy has been purchased. Common ones are verifying address or qualifications for discounts.

Agent reviews: How many and what quality are the reviews of the Insurance Agency you selected.

Reliable insurance providers have a solid reputation for customer service and claims support. That peace of mind can be priceless, especially when you need help the most. If there are concessions in these areas make sure the price savings enough to compromise and you can adapt to the concession.

Step 4: Finalize Your Policy with Confidence

Once you find a reliable insurance policy that fits your needs and budget, finalizing it should be quick and straightforward. Agencies like Oyer Insurance Agency make this easy—they walk you through the paperwork, explain any confusing terms, and help set up payment options.

They can also advise you on bundling vehicle insurance with other policies like homeowners or renters’ insurance, often saving you money.

Final Thoughts

Finding reliable Ohio vehicle insurance in minutes is completely achievable when you know what to look for and where to turn. Start by understanding your coverage needs, use trusted agencies like Oyer Insurance Agency to get personalized quotes fast, focus on the value of coverage rather than just price, and finalize your policy with confidence.

Don’t wait until you’re facing an accident or a ticket. Take a few minutes now to secure your vehicle with insurance that truly protects you. If you want expert help tailored to Ohio drivers, I highly recommend reaching out to make the process simple, transparent, and stress-free.

Comments